Services

Capital Fund Raising

Capital fundraising can be nerve wrecking if one does not have the know-how and you have to juggle your time between the business operations and seeking capital. We will help you to manage your time so that you could focus on the business operations. Capital Fundraising is usually conducted to raise major sums for a building or endowment, and generally keep such funds separate from operating funds.

Corporate Advisory

We can help to resolve crisis and disputes between the businesses and their clients.

Debt Financing

The principal source of debt funding for most business owners is a group of their relatives and friends. However, for a high-growth or capital intensive business, money loaned from personal sources doesn’t always do the trick. Banks and finance companies can fill this gap. In recent years, banks have seen intense interest in their loan offerings for start-ups. Most finance loan companies and banks offer services and products that have been crafted to fulfil the needs of small businesses. These include factoring loans, working capital loans, purchase loans and more.

Equity financing

BUSINESS FINANCING

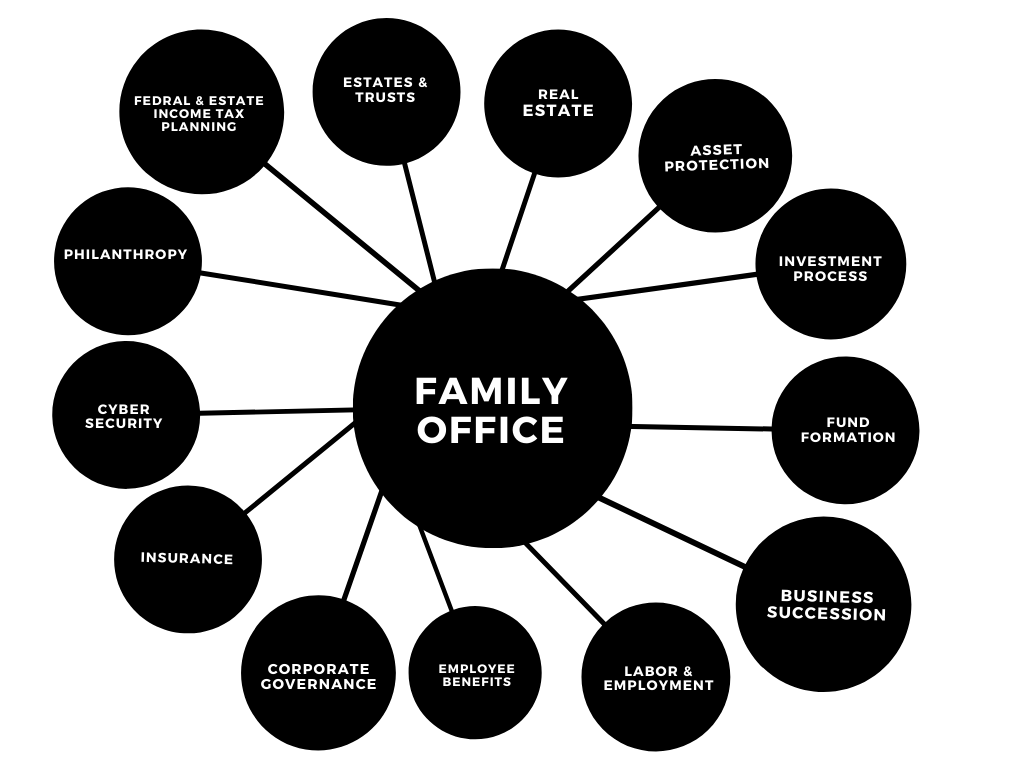

Family office

Our scope spans from offering budgeting, insurance, charitable giving, family-owned business, wealth transfer, tax services and more.